Highlights:

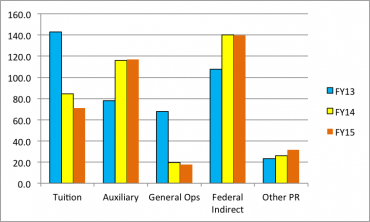

- Tuition balances carried over from prior fiscal years have been reduced by more than 50% – from $143M in FY13 to $71.1M in FY15.

- This represents a decrease from a 16% carryover at the end of FY 2013 to 7.3% at the end of FY 2015, well below the 12% threshold established by new Board of Regents and legislative policies.

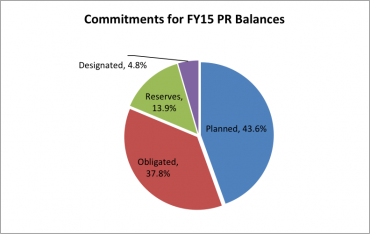

- All but $3.8M of the carryover from FY15 is already obligated or planned for various university programs.

- Overall PR balances have decreased by 10% over the same period.

- 81% of carryover balances are obligated or planned for expenses the campus will incur in FY16. Another 4.8% has been designated for specific uses.

- Of the $52.2M among ALL funds classified as reserves, 93% are federal dollars essential to the research enterprise, especially at a time when federal research funding is declining. Only $3.8M is available for other uses.

- Our balances are well below those of peer institutions, including Big 10 peers.

- There are no state tax dollars in any of these funds.

- The campus has instituted a new system of quarterly reporting of balances – the only campus in the UW System with such a reporting method. Campus units are reporting balances in a number of categories, including tuition, general operations and auxiliary operations so that we can monitor balances and make adjustments on a real time basis.

- If we exceed balances of 12% in any of these areas, we will provide detailed explanations of how we intend to use these funds.

Detailed Information by Fund Type:

- Tuition

- The tuition balance was reduced from $143M in FY13 to $71.1M in FY 15 – a decrease of $71.9M. This is a decrease from 16% to 7% in carryover.

- Of the $71.1M carried over from FY15, $67.3M is either obligated or planned for expenses the campus will incur in FY16. Only $3.8M is a true reserve. The reserve will be utilized this year as we experienced a modest decline in our enrollment.

- Auxiliaries

- An auxiliary enterprise furnishes goods or services to students, staff or the general public and charges a fee which is directly related to the good or service provided. Examples include residence halls, food service, parking and athletics.

- These are self-funding/self-sustaining operations that carry balances in order to pay short term bills and to fund long term projects (such as building new facilities or major equipment upgrades)

- From FY13 to FY15 the aggregate carryover balance in all auxiliary accounts increased from $78M to $117M, or from 19% carryover to 29% carryover. Much of that increase is due to that fact that building projects are being approved and moving forward more slowly than anticipated, and therefore the funds set aside to pay for them are not being spent as quickly.

- General Operations

- These accounts, which are Fee-for-Service or Revenue Producing Activities, are generated by self-supporting operations in colleges and schools on campus, and are dispersed in several thousand individual accounts. They pay for operations that range from relatively small expenditures (such as key deposits, copy room chargebacks, chemistry storerooms, music equipment rentals) to large (such as the Wisconsin Center for Education Research, the School of Veterinary Medicine Teaching Hospital, and the Babcock Dairy Plant).

- From FY13 to FY15 the aggregate carryover balances in these accounts decreased by $49.9M ($67.8M to $17.9M), or from 39% carryover to 9% carryover. The decrease is largely due to the new system the campus put in place to monitor balances on a quarterly basis allowing us to make adjustments as necessary.

- Federal Indirect Funds

- Because of their unique nature and critical importance to sustaining UW-Madison’s entire research enterprise, federal indirect costs were excluded from the 12% threshold imposed by the Legislature. However, UW-Madison does report the total balance by category to the Board of Regents and Legislature.

- Indirect costs are real costs the institution incurs that support research activities but cannot be directly charged to a research grant or contract. Examples include libraries, physical plant operation and maintenance, utility costs and administrative expenses that support the research enterprise.

- From FY13 to FY15 the federal indirect carryover balance grew from $108M to $140M. However, these funds are designated to support and serve as a reserve against the entire $1.1 billion research enterprise.

- With federal research funding declining, it is critical that the campus have the ability to provide bridge funds to allow researchers that have exhausted existing research grants to continue their research projects while they are waiting for the next grant to be awarded. In FY15 alone the campus used $10M of federal indirect funds to keep research projects moving forward and that number is expected to increase in the future.

- Of the $140M carried over into FY16, only $48.5M is true reserves. The remaining $91.3M is obligated or planned for future expenditures the campus knows it will incur.

- Other Unrestricted Program Revenue Operations

- Other PR Operations include funding for utilities and certain UW-Extension operations, as well as the State Lab of Hygiene and the WI Veterinary Diagnostic Lab. Although the budgets and balances for the two labs are listed as part of UW-Madison, they are in fact separate state agencies and the university has no control over their budgeting or operations.

- Aggregate carryover balances in Other PR Operations grew by $8.5M between FY13 and FY15, from $23M to $31.6M. This represents a carryover of 13% and 19% respectively.

- Of the $31.6M carryover in FY15, $7.9M is for the labs and $19.1M is for debt service costs the campus knows it will incur.